因為時間關係,我把 20 本縮減為 5 本。

105Please respect copyright.PENANAWrSeSqs2bs

這連續五天 (Mar/05~Mar/09),我會列出五本會計學/數學相關書籍,從裡頭擷取一頁 (結果超過一頁~) 內容,然後寫一個小小的心得。

105Please respect copyright.PENANAKJgrC6fkd7

from 博客來網路書店・我的電子書櫃「日記創挑書單」

105Please respect copyright.PENANArnav1nJDNj

105Please respect copyright.PENANAVtnhBTdRNW

今天這本書是《用生活常識就能看懂財務報表》,作者是林明樟。

https://www.books.com.tw/products/E050012950?sloc=main

105Please respect copyright.PENANARTGeOcxkx8

目錄

PART1 看財務報表就是在學語言105Please respect copyright.PENANAOWIKmiQxMV

1-1 財報不能單看一張105Please respect copyright.PENANAcSLU4GPokZ

1-2 財務報表是一種語言學,難的是「中翻中」105Please respect copyright.PENANAyhI81BbJgW

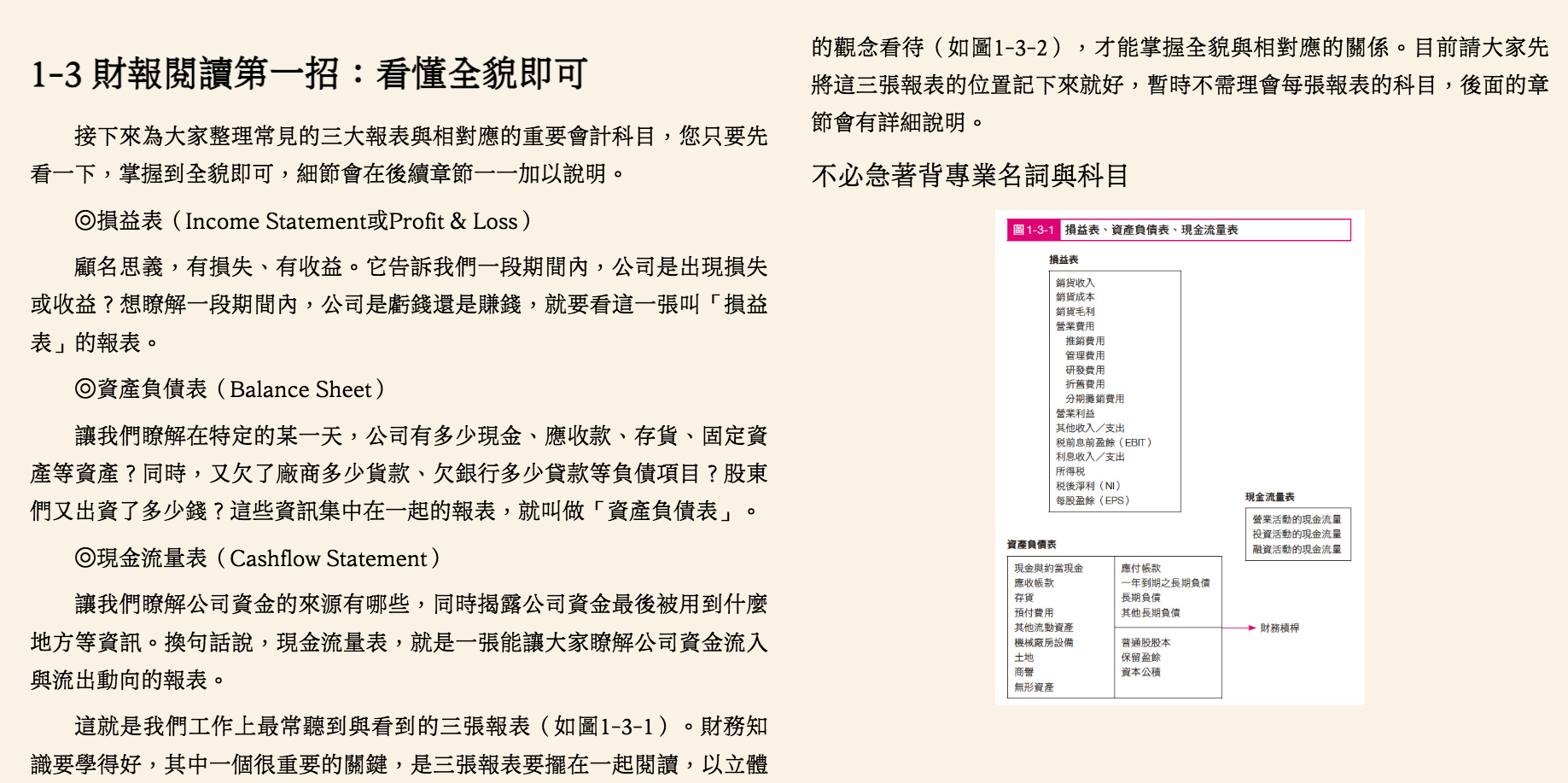

1-3 財報閱讀第一招:看懂全貌即可105Please respect copyright.PENANAgv54HHkgZI

附錄 會計師查核意見標準解釋105Please respect copyright.PENANAJ1O37HSgwK

105Please respect copyright.PENANAWoND3znK9w

PART2 損益表:告訴您公司到底是賺還是虧105Please respect copyright.PENANAqZZn546JD3

2-1 用生活常識推導出正確的損益表觀念105Please respect copyright.PENANA49xUpEjWll

2-2 量大不一定最好105Please respect copyright.PENANAxNY6BQvzh6

2-3 收入、成本和費用,哪一個重要?105Please respect copyright.PENANAROlRY3cMQ2

2-4 損益表是預估,不是100%確定的報表!105Please respect copyright.PENANAzDOMqOUnXP

2-5 決策幫手:損益兩平點105Please respect copyright.PENANAqIg5pVrYAZ

105Please respect copyright.PENANAaUEyUam7Lu

PART3 資產負債表105Please respect copyright.PENANA2i3bxV6hZR

3-1 資產負債表的基本概念105Please respect copyright.PENANApL8RsVfD6L

3-2 資產負債表的特殊科目說明105Please respect copyright.PENANACwL0ME8DuG

3-3 活用資產負債表:以長支長105Please respect copyright.PENANAl2SA7zItnb

3-4 大量的盈餘,怎麼分配或處理105Please respect copyright.PENANAnyA56e9B7W

3-5 經營能力好壞判斷:損益表與資產負債表的綜合運用105Please respect copyright.PENANACfYRm1lzv8

3-6 經營能力實戰分析105Please respect copyright.PENANArhklPjhGQm

3-7 經營能力的進階運用:做生意的完整週期105Please respect copyright.PENANAMarG4MnORg

3-8 經營能力的進階運用:淨利率這麼低能活嗎?105Please respect copyright.PENANAUAdONiknL6

3-9 經營能力的進階運用:兩家公司RoA很接近,該怎麼判斷好壞?105Please respect copyright.PENANANlO7EEqNX8

105Please respect copyright.PENANAsxFZR9KGoL

PART4 現金流量表105Please respect copyright.PENANAuoGlhUhk8o

4-1 消失的第三張最關鍵報表105Please respect copyright.PENANAUw4lKcyZaU

4-2 現金流量表上的數字涵義105Please respect copyright.PENANAwl4lvo3NAJ

4-3 現金流量表案例解析105Please respect copyright.PENANAtucQ9XJovh

4-4 財報現金流量觀念總整理105Please respect copyright.PENANAz5rR7J2aM3

105Please respect copyright.PENANAAvjb5AnsBo

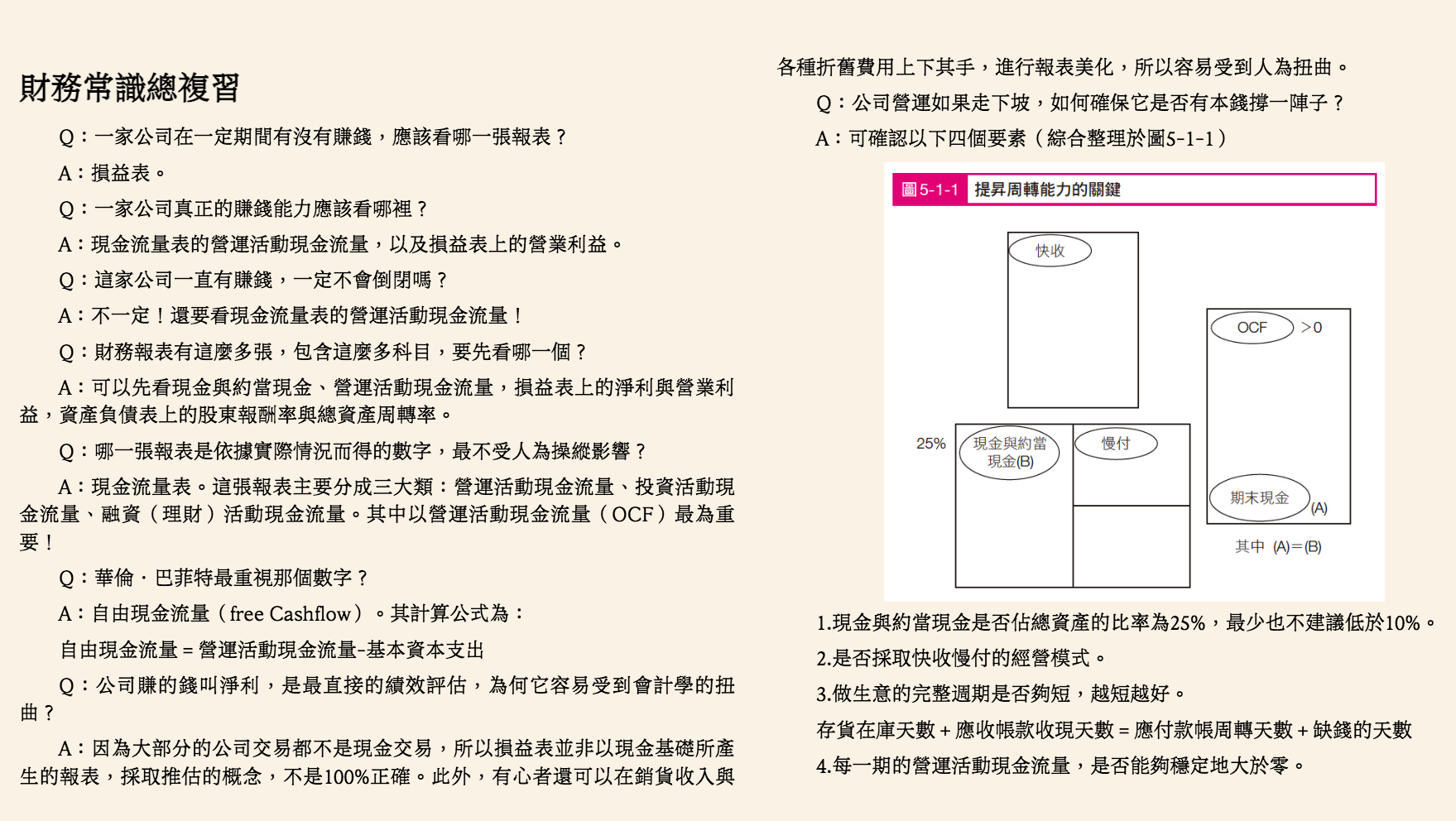

PART5 附錄─財務常識總複習

105Please respect copyright.PENANAJkMBHdV6Se

105Please respect copyright.PENANAxVNV49ehrH

from《用生活常識就能看懂財務報表》,以下截圖同

105Please respect copyright.PENANAQSniTfPk1C

這本書是用相對口語的語言、日常生活的例子來講三種財務報表:損益表、資產負債表、現金流量表。可以看出,作者林明樟不是學院派的教學者,而是有著真實投資經驗的實戰者 (事實上,他還有創業經驗);透過作者的整理和分享,這三張財報也立體起來,不再是教科書裡的白紙黑/紫字了。

105Please respect copyright.PENANAyG5to16Q8e

根據作者所言,這三張財報,最後出現的是「現金流量表」,那是因為上個世紀八〇年代發生許多弊案,美國財務會計準則委員會要求,所有上市公司的財報,需要加入第三張報表,也就是現金流量表。

105Please respect copyright.PENANA6r9jpcN0Sa

105Please respect copyright.PENANAxlOkAIgrY2

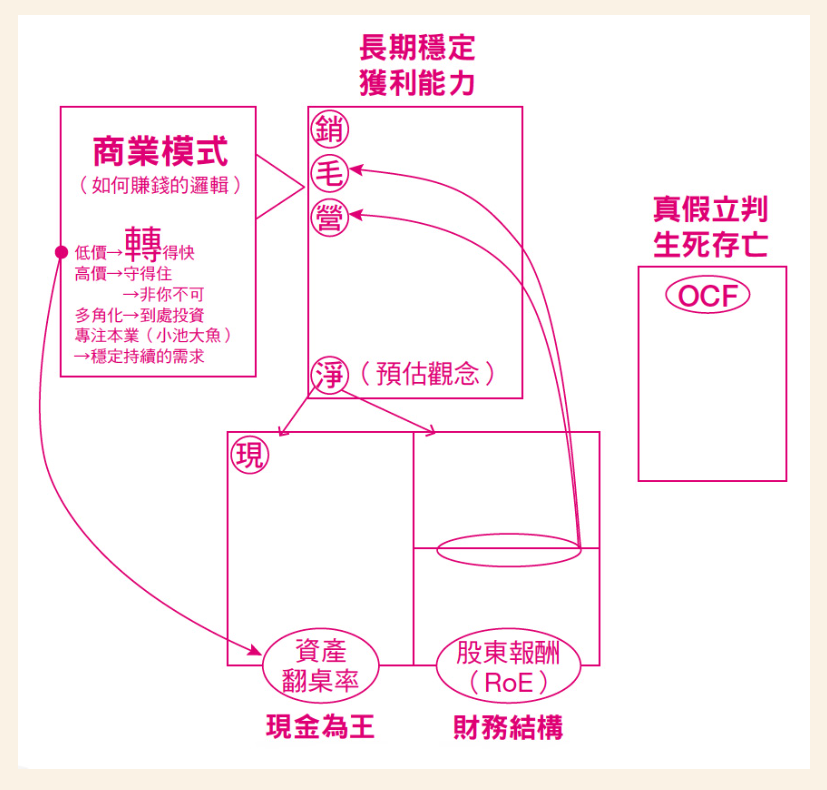

這本書的資訊量和含金量相當大,特別是對我這種會計菜雞而言,只是翻閱、瀏覽、節錄是不夠的,基於時間限制,今天就介紹到此,如果各位有興趣的話,可以去找書——當然包括購買,活絡一下書市也好——來看,這裡再放上一張我覺得很重要的圖 (全書不只出現一次),供大家參考。

105Please respect copyright.PENANA36WOOYx06k

【三張財務報表的立體觀】105Please respect copyright.PENANAWEI4tL7khv

105Please respect copyright.PENANAyNXnYb2fBP

最中間是「損益表」、右邊是「現金流量表」、中間下方有三隔間的表是「資產負債表」(還記得會計恆等式嗎?資產=負債+權益,所以「資產負債表」就是上開那種三格長相)。

105Please respect copyright.PENANA8I0ydMLE2f

左邊那個是說明「商業模式=如何賺錢的邏輯」,不是財務報表。

105Please respect copyright.PENANAm0KkR0aSdP

「OCF」=「營業現金流」、「RoE」=「股東權益報酬率」。

105Please respect copyright.PENANAHpFR0fVTo6

105Please respect copyright.PENANAY5A8jMrNVp

【總結】

105Please respect copyright.PENANAiCg0f2cbbu

今天到此為止,我們明天見!!

105Please respect copyright.PENANArpLpL42abe

105Please respect copyright.PENANAyGea3OrZkc

【創挑出處】

https://www.penana.com/article/1647411

ns18.221.172.197da2